How Documind Makes Customs Documents Automation-Ready

It’s 3 PM on a Friday. Your customs broker just received an urgent shipment notification: 47 line items, three different origin countries, and the vessel arrives Monday morning. The exporter sent a scanned EUR.1, a handwritten packing list photo, and a commercial invoice in PDF. All in one email thread with “URGENT” in the subject line.

Sound familiar?

The Document Maze

International trade runs on paper. Every shipment crossing a border carries a trail of documents that must align perfectly: origins must match, values must reconcile, classifications must be correct.

EUR.1 Movement Certificates unlock preferential tariffs within EU trade agreements. A.TR certificates prove goods are in free circulation for Turkey-EU customs union trade. Commercial invoices establish transaction values. Packing lists detail contents. Certificates of origin verify where goods were made. Customs declarations tie everything together for border authorities.

Each document type has its own format, its own required fields, its own validation rules. And each trading partner sends them differently: structured PDFs from one supplier, phone photos from another, faxed copies from a third.

The traditional approach? Someone manually opens each attachment, reads through the document, types the relevant data into your customs system, cross-references against other documents, and hopes they don’t make a typo on the HS code that triggers an audit three months later.

What Changes with Documind

Documind sits between your inbox and your customs systems. When documents arrive, three things happen:

Classification. The system identifies what each document is. That blurry attachment? It’s a EUR.1, not a commercial invoice. The second PDF? A dangerous goods declaration that needs separate handling. Documents get sorted before anyone touches them.

Extraction. Structured data comes out: HS codes, party names, values, quantities, origin countries, certificate numbers. Not as a wall of text, but as clean fields your systems can consume. Each field carries a confidence score; high confidence flows through automatically, lower confidence gets flagged for review.

Validation. Before data moves downstream, it gets checked. Does the declared origin match the certificate type? Do quantities on the invoice match the packing list? Are all mandatory fields present for the destination country? Problems surface immediately, not when the shipment is sitting at the border.

The output is structured JSON or XML, ready for your ERP, your customs broker software, or your RPA workflows. Documind handles the document intelligence; your existing automation handles the rest.

Preferential Duty Rates

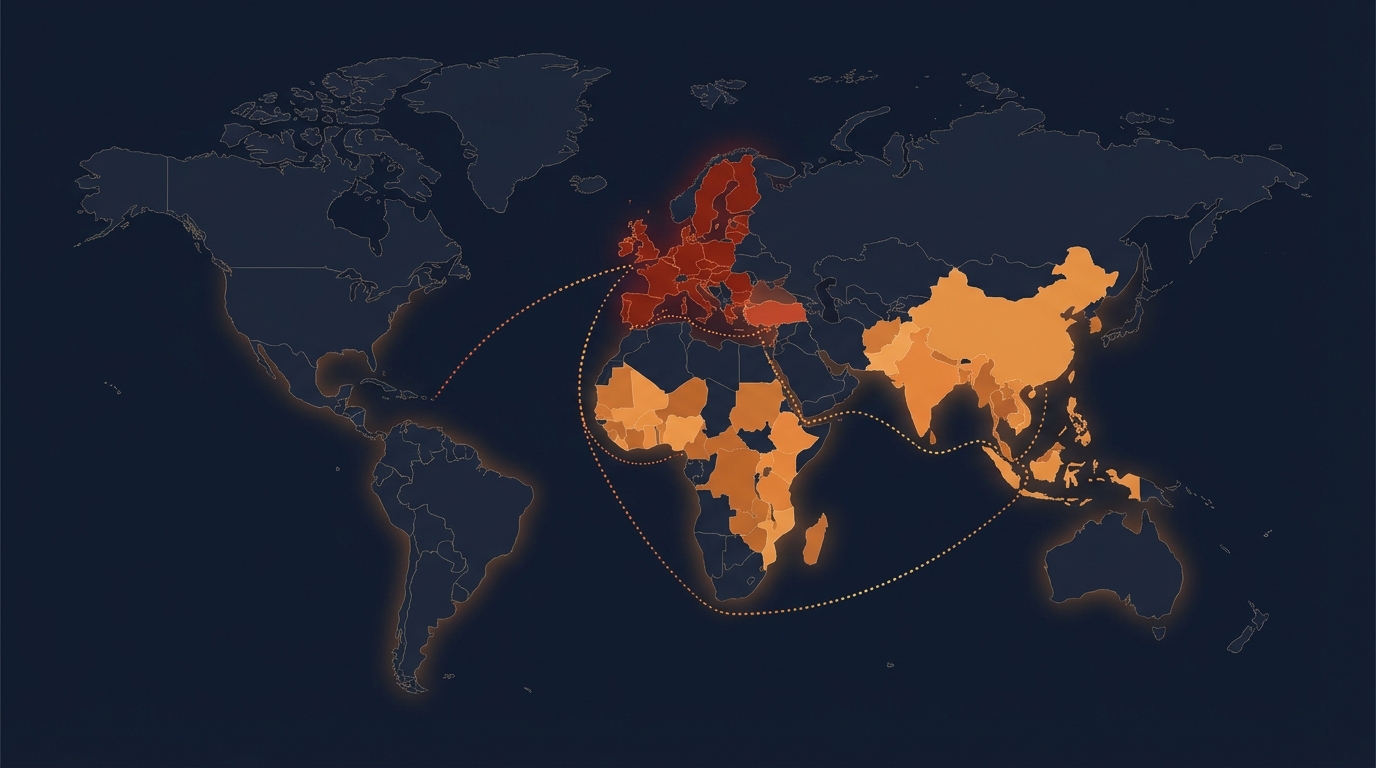

The right certificate can mean significant duty savings. But which certificate applies to which trade lane?

Turkey-EU trade needs A.TR or EUR.1. Shipments from Vietnam to Europe require FTA certificates. Developing countries use Form A. Each route has its own rules. Wrong certificate or missing fields means losing the preferential rate.

Documind extracts the right fields from each certificate type: origin declarations, validity dates, authorized signatures. The data your system needs to claim preferential rates arrives ready to use.

When Human Review Matters

Not every document should flow straight through. Some situations need expert judgment: a suspicious invoice value, a certificate about to expire, inconsistent origin information.

Documind flags these cases; your team makes the call. The goal isn’t to automate everything. It’s to automate the routine so your specialists can focus on cases that genuinely need their expertise.

Multi-line invoices get extracted line by line. Split shipments get linked by reference number. Amended documents get recognized as updates with changed fields highlighted.

The Numbers That Matter

Customs brokers using document automation report consistent patterns:

Processing time drops from 15-20 minutes per declaration to under 2 minutes for data preparation. The extraction itself takes seconds; the remaining time is human review of flagged items.

Error rates fall significantly. Manual transcription introduces mistakes: a transposed digit in an HS code, a misspelled consignee name, a value in the wrong currency field. Structured extraction eliminates transcription errors entirely.

Duty optimization improves. When preferential certificates are processed correctly and consistently, legitimate duty savings get claimed. When they’re processed manually under time pressure, opportunities get missed.

Audit readiness becomes automatic. Every extraction includes confidence scores, source references, and validation results. When customs authorities ask questions months later, the audit trail exists.

Getting Started

Documind processes customs documents across all major trade lanes and certificate types. The integration point is simple: documents go in, structured data comes out.

Your existing systems (whether that’s a customs broker platform, an ERP, or custom automation) consume the output. You keep your workflows, your business rules, your exception handling processes. Documind adds the document intelligence layer that makes everything else faster.

For customs brokers processing hundreds of declarations daily, for importers managing complex multi-origin supply chains, for exporters navigating preferential agreements across multiple markets: this is how document processing scales without scaling headcount.